Dining & drinking on great patios in Portland!

Author: Tom Kerr

18 Bodacious Bridges

(Credit: Iriana Shiyan/Shutterstock)

(Credit: Iriana Shiyan/Shutterstock)

Yahoo Homes has a great article on 13 ways to increase your home’s curb appeal.

Remember – First impressions are everything!.

And if you need help with any of this, or need some professional referrals, don’t hesitate to contact me.

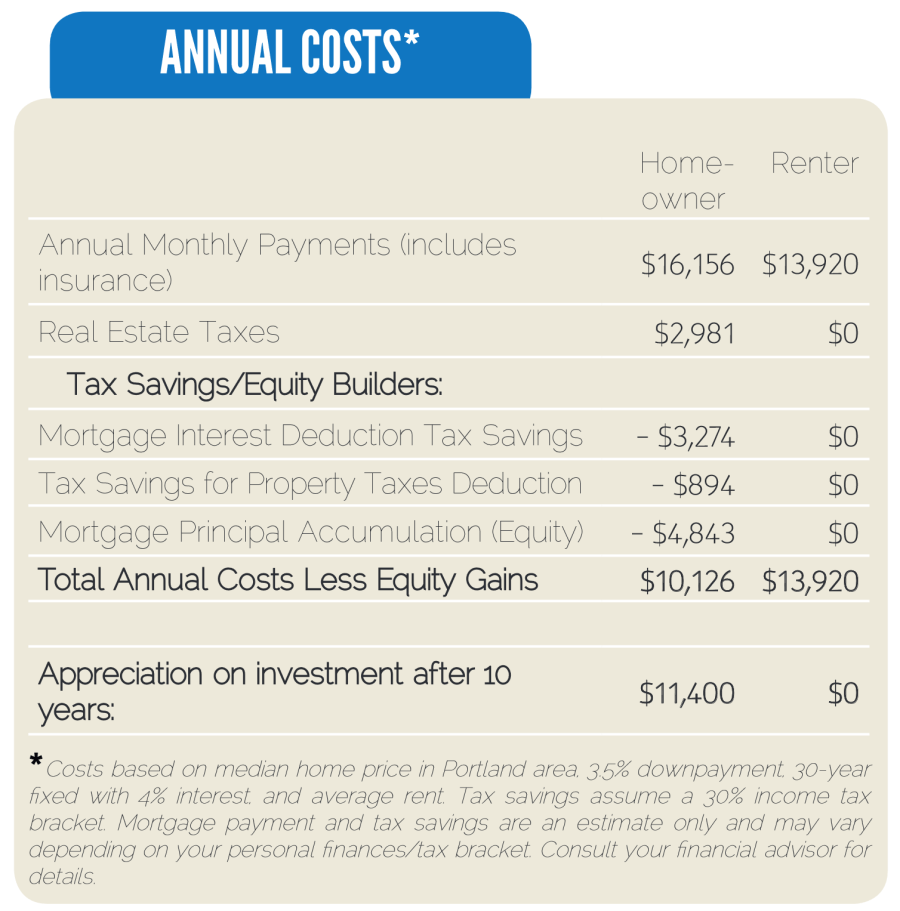

There are 3 main advantages to moving from renting to homeownership in today’s market.

Tax Savings

Deduct the cost of your mortgage loan interest from your state and federal income taxes. Additionally, you may deduct a portion of your property taxes.

Appreciation Potential

Real estate is a good long-term investment. Over the last ten years, appreciation in the Portland Metro area averaged 4%. Additionally, as you pay down your mortgage loan, your equity (wealth you have in your home) increases.

Stability

A fixed mortgage payment will not increase for 15 to 30 years, whereas Portland area rents increased an average of 6% this past year.

Bonus Fact

Homeowners don’t move as frequently as renters, tend to volunteer in the community more, and enjoy a net worth 34 times as much as a renter.

If you’re ready to make the switch from renting to owning, contact me!

The Wooden Shoe Tulip Fest in Woodburn is going on now through May 3rd. Stroll through 40 acres of stunning beauty, experience expansive views of vineyards, distant mountains, and a few mud puddles! Fresh flowers, food, and fun for all. There is nothing like the colors of the tulip fields back by Mt. hood and surrounded by fresh, country air. Details can be found at: www.woodenshoe.com

Examine your roof! Binoculars are a great way to get a closer look. Or call a roof cleaning professional to climb up to the tip top! They usually will clean the gutters too! Regular roof maintenance can extend the life of your roof by several years.

Need a referral for a roofing professional? Send me a message.

There hasn’t been a better time to buy vs. rent in over ten years and I would like to show you why. Consider these advantages:

- Low interest rates

- Good inventory of available homes in many areas

- Affordable home prices making for affordable house payments

- Mortgage interest write off (consult your Tax Advisor)

Call or email me for a FREE confidential Real Estate consultation.

Shamrock Run – Sunday, March 15th

http://www.shamrockrunportland.com/

Kell’s Irish Pub – March 13th-17th

http://www.kellsportland.com/st-patricks-festival/

Paddy’s – Tuesday, March 17th

http://paddys.com/st-patricks-day/

The Case-Schiller Home Price and Federal Housing Finance Agency weighed in last week with data on December home price trends, which confirmed in 2015 that we are still going to see the accelerating appreciation of home prices. They expect this trend to continue.

If you’re ready to buy or sell your home, please contact me for advise in how to navigate today’s market.

Comparing the average price of homes in the twelve months of this year ($333,600) with the average price of homes sold in the twelve months ending January 2014 ($311,900) shows an increase of 7.0%. In the same comparison, the median has increased 7.5% from $267,000 to $287,000.

It’s a great time to sell! Contact me for a free price estimate of your home and see how much it could sell for in today’s market.